Who Must File

Exemptions & Standard Deduction

Tax Rate Schedules

Phaseouts

Mileage Rates

Maximum Contribution Limits to IRA, SEP and 401K

Social Security

State Forms

Who Must File

| Single | Under 65 65 or older |

$8,950 $10,300 |

| Joint | Both under 65 One 65 or older Both 65 or older |

$17,900 $18,950 $20,000 |

| Head of Household | Under 65 65 or older |

$11,500 $12,850 |

| Married filing Separate | Any age | $3,500 |

| Qualifying Widow(er) with dependent Child | Under 65 65 or Older |

$14,400 $15,450 |

New for 2008

Congress rarely make it simple. So no "fixes" for AMT (Alternative Minimun Tax), tax rate parity for joint returns (the mange penalty still applies for medium earners), extenders were passed so AMT, etc did not expire after 2007.

Max. Contribution I Social Security I State Forms

2008 Exemptions & Standard Deduction

| Exemptions | $3,500 |

| But remember the Phaseout rules | |

Standard deduction

| Single | 5,450 |

| Blind (+1,350) | $6,800 |

| Over 65 (+1,350) | $6,800 |

| Blind and over 65 | $8,150 |

| Head of Household | $8,000 |

| Blind (+1,350) | $9,350 |

| Over 65 (+1,350) | $9,350 |

| Blind and over 65 | $10,700 |

| Joint | $10,900 |

| Blind (+1,050) | $11,950 |

| Over 65 (+1,050) | $11,950 |

| Blind and over 65 | $13,000 |

| Separate | $5,450 |

| Blind (+1,050) | $6,500 |

| Over 65 (+1,050) | $6,500 |

| Blind and over 65 | $7,550 |

| Qualifying Widow(er) with dependent child | $10,900 |

| Blind (+1,050) | $11,950 |

| Over 65 (+1,050) | $11,950 |

| Blind and over 65 | $13,000 |

| Dependent (no earned income) | $900 |

| Blind (+1,350) | $2,250 |

| Over 65 (+1,350) | $2,250 |

| Blind and over 65 | $3,600 |

| Dependent with Earned Income (Wages) | Amount of earned income plus $300 up to standard deduction for filing status |

| Blind (+1,350) | $1,350 Plus: amount of earned income plus $300-- up to standard deduction for filing status |

| Over 65 (+1,350) | $1,350 Plus: amount of earned income plus $300-- up to standard deduction for filing status |

| Blind and over 65 | $2,700 Plus: amount of earned income plus $300-- up to standard deduction for filing status |

California Standard deduction

| Single/ Married/ Separate | $3,692 |

| Joint/ Head of Household/ Qualifying Widow(er) | $7,384 |

Max. Contribution I Social Security I State Forms

2008 Tax Rate Schedules

SINGLE

| Taxable income is over | But not over | The tax is | Plus | Of the amount over | ||||

| 0 | 8,025 | 0 | 10% | 0 | ||||

| 8,025 | 32,550 | 802.50 | 15% | 8,025 | ||||

| 32,550 | 78,850 | 4,481.25 | 25% | 32,550 | ||||

| 78,850 | 164,550 | 16,056.25 | 28% | 78,850 | ||||

| 164,550 | 357,700 | 40,052.25 | 33% | 164,550 | ||||

| 357,700 | ------------ | 103,791.75 | 35% | 357,700 |

MARRIED FILING JOINTLY or QUALIFYING WIDOW(ER)

| Taxable income is over | But not over | The tax is | Plus | Of the amount over | ||||

| 0 | 16,050 | 0 | 10% | 0 | ||||

| 16,050 | 65,100 | 1,605 | 15% | 16,050 | ||||

| 65,100 | 131,450 | 8,962.50 | 25% | 65,100 | ||||

| 131,450 | 200,300 | 25,550 | 28% | 131,450 | ||||

| 200,300 | 357,700 | 44,828 | 33% | 200,300 | ||||

| 357,700 | ------------ | 96,770 | 35% | 357,700 |

HEAD OF HOUSEHOLD

| Taxable income is over | But not over | The tax is | Plus | Of the amount over | ||||

| 0 | 11,450 | 0 | 10% | 0 | ||||

| 11,450 | 43,650 | 1,145 | 15% | 11,450 | ||||

| 43,650 | 112,650 | 5,975 | 25% | 43,650 | ||||

| 112,650 | 182,400 | 23,225 | 28% | 112,650 | ||||

| 182,400 | 357,700 | 42,755 | 33% | 182,400 | ||||

| 357,700 | ------------ | 100,604 | 35% | 357,700 |

MARRIED FILING SEPARATELY

| Taxable income is over | But not over | The tax is | Plus | Of the amount over | ||||

| 0 | 8,025 | 0 | 10% | 0 | ||||

| 8,025 | 32,550 | 802.50 | 15% | 8,025 | ||||

| 32,550 | 65,725 | 4,481.25 | 25% | 32,550 | ||||

| 65,725 | 100,150 | 12,775 | 28% | 65,725 | ||||

| 100,150 | 178,850 | 22,414 | 33% | 100,150 | ||||

| 178,850 | ------------ | 48,385 | 35% | 178,850 |

ESTATES AND TRUSTS (Form 1041)

| Taxable income is over | But not over | The tax is | Plus | Of the amount over | ||||

| 0 | 2,200 | 0 | 15% | 0 | ||||

| 2,200 | 5,150 | 330 | 25% | 2,200 | ||||

| 5,150 | 7,850 | 1,067.50 | 28% | 5,150 | ||||

| 7,850 | 10,700 | 1,823.50 | 33% | 7,850 | ||||

| 10,700 | ------------ | 2,764 | 35% | 10,700 |

CORPORATIONS (Form 1120)

| Taxable income is over | But not over | The tax is | Plus | Of the amount over | ||||

| 0 | 50,000 | 0 | 15% | 0 | ||||

| 50,000 | 75,000 | 7500 | 25% | 50,000 | ||||

| 75,000 | 100,000 | 13,750 | 34% | 75,000 | ||||

| 100,000 | 335,000 | 22,250 | 39% | 100,000 | ||||

| 335,000 | 10,000,000 | 113,900 | 34% | 335,000 | ||||

| 10,000,000 | 15,000,000 | 3,400,000 | 35% | 10,000,000 | ||||

| 15,000,000 | 18,333,333 | 5,150,000 | 38% | 15,000,000 | ||||

| 18,333,333 | ------------ | ------------ | 35% | 0 |

Max. Contribution I Social Security I State Forms

2008 Phaseouts

Many of the Tax Benefits you receive are limited or even completely phased out depending on the amount of your Adjusted Gross Income (AGI). This is a partial list for 2008.

This is one of the examples of Congress's extremely short sighted but very heavy handed way of sticking it to a very large segment of middle class taxpayers. It is an indication of the philosophy of Congress, which in its basest terms, is divide & conquer.

Here are some examples:

S = Single

HH = Head of Household

J = Joint

QW = Qualifying Widow(er) with dependent child

| ITEM | STATUS | BEGINS | ENDS |

| Exemptions | Single | 159,950 | 282,450 |

| HH | 199,950 | 322,450 | |

| Joint/QW | 239,950 | 362,450 | |

| Separate | 119,975 | 161,225 | |

| Itemized Deductions | S/HH/J | 159,950 | (Complicated; See worksheet in Schedule A Instructions.) |

| Separate | 79,975 | (See worksheet in instructions.) | |

| Student Loan Interest | S/HH | 55,000 | 70,000 |

| (Max 2,500) | Joint | 115,000 | 145,000 |

| Tuition (Credit) 4,000 |

S/HH Joint |

Under Under |

65,000 130,000 |

| Tuition (Credit) 2,000 |

S/HH Joint |

65,000 130,000 |

80,000 160,000 |

| Tuition (Credit) None |

S/HH Joint |

Over Over |

80,000 130,000 |

| Hope Ed Credit (Max $1,800 per CHILD for 1st. two years on college) |

S/HH | 48,000 | 58,000 |

| Joint | 96,000 | 116,000 | |

| Lifetime Ed Credit (Max $2,000 per RETURN) |

S/ HH | 48,000 | 58,000 |

| Joint | 96,000 | 116,000 | |

| Adoption Credit (Max $11,650) |

S/HH/J | 174,730 | 214,730 |

| Passive Rental Losses (Max $25,000) |

S/HH/J | 100,000 | 150,000 |

| ROTH IRA Eligibility (No Tax benefit) |

S/HH | 101,000 | 116,000 |

| Joint | 159,000 | 169,000 |

Max. Contribution I Social Security I State Forms

2008 Mileage Rates

For deducting or reimbursing 2008 business mileage on a personally owned vehicle.

Charity and Medical standard rates are for purposes of deductions on Schedule A (Itemized Deductions).

Note: Both Business and medical moving rates were adjusted upward as of July 1, 2008. The deductable total is the sum of the 2 rates.

| Business rate | Jan 1 - June 30, 2008 | 50.5 cents per mile |

| July 1 - Dec 31, 2008 | 58.5 cents per mile | |

| Charity rate | 14 cents per mile | |

| Medical & Moving rate | Jan 1 - June 30, 2008 | 19 cents per mile |

| July 1 - Dec 31, 2008 | 27 cents per mile |

Max. Contribution I Social Security I State Forms

2008 Maximum Contribution

| IRA | |

| All IRA's (Deductible, non deductible, Roth) | $5,000 |

| Over 50 | $6,000 |

| IRA SIMPLE | |

| Employee - Any % of Wages to a Maximum contrubution of Over 50 (plus 2,500) | $10,500 |

| Employer - Matching Contributions up to 3% of Wages | $13,000 |

| 401(K) & 401(b) | |

| Employee | $15,500 |

| Over 50 (plus 5,000) | $20,500 |

| Employer - Up to 20% of Wage to a Maximum wage of | $220,000 |

| Maximum Dollar Amt (Employer + Employee) | $44,000 |

| KEOGH/SEP (Self Employed) | |

| Depending on type of plan: Up to Either 12.+% of net Profit or 20% of Net Profit ( Talk to Plan Distributor) - Maximum contribution is | $46,000 |

Max. Contribution I Social Security I State Forms

Social Security

Limits on Earnings if under 65

If you need additional quarters to qualify for Retirement or Medicare (40 quarters) this is the amount you will need to earn for 1 quarter of coverage. You can earn up to 4 quarters per year.

| Maximum | Exempt Earnings |

| Under Age 65 | |

| You will have to return $1 for every $2 dollars you earn over | $13,560 |

Earnings required for Coverage

If you are under age 65 and drawing Social Security there is an annual limit to your earnings after which you must return some of the Social Security received. Earned Income which are earnings from Wages (W-2) and from Self Employment (Schedule C, or Partnership) must be counted. All earnings are reported to the Social Security Administration Annually.

| Year | Earnings required for one quarter of coverage |

| 2007 | $1,000 |

| 2008 | $1,050 |

Social Security Historical Rates

Social Security is a sound system[?] Here is how Social Security rates have risen from its inception in 1937 to the present. An eye opener.

Max. Contribution I Social Security I State Forms

State Forms

Note there are 9 states that do not have a State Income Tax.

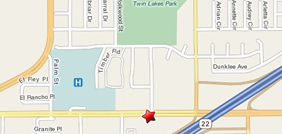

Map

Click on the map to view a larger image.

Click on the map to view a larger image.Use MapQuest to get the Directions.

Address

12822 Garden Grove Blvd. Unit CGarden Grove, CA

92843 Phone: (714) 750-0181

Fax: (714) 750-0184

Website: https://nicholsincometax.com